26/06/2017 – Euratex — auf Deutsch lesen

For a smart and smooth Brexit

The U.K. lies in 3rd place when ranking the EU27s most important trade partners in textile and clothing goods! Recommendations for a smart Brexit.

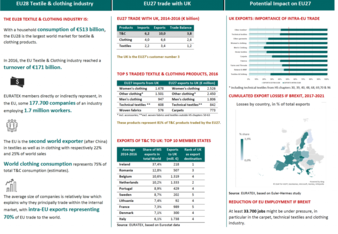

The EU28 textile and clothing industry is one of the major industries in the EU. With 1.7 million workers, it generated a total turn- over of 171 billion € in 2016. European textile and clothing companies are globally leading, regarding technical textiles, sophisticated high-quality yarns and fibres, as well as high-end apparel goods.

The U.K. lies in 3rd place when ranking the EU27s most important trade partners in textile and clothing goods. On average the U.K. imported products almost 10 billion € worth from the EU 27, while its exports amounted to 6.2 billion € in the same period (2014 - 2016). The textile and clothing industries of the EU 27 and other European neighbouring countries on the one hand and the U.K. on the other hand are closely interlinked in terms of supply chains, foreign direct investments and exchange of workers.

Common interests

It is thus in the common interest of the U.K. and the EU27 industries to plead in favour of a smart and smooth Brexit, enabling the current highly integrated supply chains to keep on working smoothly from fibres to end products.

Key messages

An uncontrolled separation of the U.K. from the EU (“Hard BREXIT”) would have a very serious impact on the industries of both sides, i.e. given comparably high import tari s that would apply in the textile and clothing sector.

The avoidance of legal uncertainty is of high priority for economic operators, requiring an early arrangement on the legal relationship between both contracting parties in the medium term.

A transitional arrangement should cover suspension of customs duties and all legal and regulatory areas with relevance for the textile and clothing industry.

Any transitional arrangement should directly lead to a comprehensive trade and investment agreement in the long run.

A future comprehensive EU27-U.K. trade and investment agreement should consider the already existing close economic relationship between the European textile and clothing industries.

Recommendations

Avoidance of legal uncertainty for all economic participants by adopting a transitional arrangement that would be applied between the 29 March 2019, the first day of the exit of U.K. from the EU and the date of the entry into force of the comprehensive and ambitious agreement between EU27 and U.K. (2022- 2023?). The latter should also take into consideration the existence of a customs union between the EU and Turkey, and future FTA between U.K and Switzerland as the EU -Switzerland 1972 agreement will no longer apply to U.K.

Clear transitional arrangements bridging the gap between the completion of the U.K. exit process and the entry into force of the future EU-UK agreement. These should maintain the suspension of customs duties, efficient customs procedures and mutual recognition of regulatory standards.

3. The major threat: the imposition of high customs duties. Avoiding new tariffs between the EU and the UK is a key factor for a future EU-U.K. relationship. In the textile and clothing sector, the level of customs duties is generally higher than in other industrial sectors. Today, for the third countries not ben- e ting from any FTA or GSP regime, the EU duties are 4 - 5% for yarns, 8% for fabrics and 12% for clothing entering the EU market. If duties of that kind were introduced, even on a temporary basis, between the EU27 and the U.K., it would have a negative impact on both industries.

4. The future trade and investment agreement between the U.K. and the EU 27: Any agreement negotiated should bring opportunities for growth, investment and job creation on both sides of the Channel. It should cover:

• the confirmation of a zero-duty level,

• customs procedures: customs clearance, documentation, etc. and customs legislation,

• public procurement, State aids and protection of investments,

• IPR provisions: trademarks, Registered Community Designs (RCD), Unregistered Community Designs (UCD), Unregistered Design Right (CUDR),

• market surveillance against non-compliant products, with standards, climate and REACH obligations

• recognition of the specific textile and clothing regulation (Annex 2),

• sustainable development: working conditions, fight against climate change, decent labour in global supply chains etc.,

• ensure the maintenance of a fair access to research & innovation programs in the context of the future FP9 and other funds for innovation and competitiveness with a commensurate financing commitment from the U.K.

• free movement of nationals (designers, skilled workers, etc.)

5. Regulatory divergence: a real risk that should be dealt with. The risk of a regulatory divergence such as in the field of chemical regulation and REACH, CO2 emissions, consumer protection rules and standards (Personal Protective Equipment (PPE), technical textiles, construction, health, etc.), state aid, access to public procurement, labour laws and IPR is real. Divergences in the regulatory legislation of the EU and U.K. would create NTBs and result in high additional costs for consumers (i.e. flame-retardant standards). Euratex aims at having an on-going harmonisation of legislation between U.K and EU.

6. The pursuit of a common approach within the CEN (European Committee for Standardization). Both textile and clothing industries plead in favour of the U.K. remaining in the sectoral bodies dealing with textiles and clothing within the CEN and in particular the Standardization committee dealing i.e. with PPE, smart textiles, children’s clothing.

7. Trade and rules of origin: a sensitive issue. The textile and clothing industries are particularly sensitive to the intricacy of the value chains and the different balances existing between various economic and technical realities across the EU27 and U.K. Any agreement should bene t the two textile and clothing industries and not be used by third countries leveraging and/or negotiating FTAs with the U.K. or the EU27.

Even though a sectoral approach is for the moment excluded from the negotiations, the EU27 and U.K. textile and clothing industries interests must be duly considered during the discussions. In doing so the expected results should fully and primarily bene t our textile and clothing industries.

In any case, Euratex reserves the right to issue more detailed and/or specific positions and papers later according to the evolution of the negotiations whose base should be the Euratex 2011 position paper on Preferential Rules of Origin.