06/07/2022 – Cotton — auf Deutsch lesen

2022/23 Cotton consumption to decrease

USDA’s latest forecast for the upcoming 2022/23 season projects cotton consumption to decline to 26.56 million tons, down 218,000 tonnes from the previous year.

The highest cotton prices in 11 years and concerns regarding the global macroeconomic environment are expected to cap consumption growth. This is the first May outyear cotton forecast with lower consumption in 36 years, despite higher projected outyear production. Although consumption is projected to decline, this would still be the second highest level within the last 5 years.

Poor business conditions

Higher cotton lint, consumer, and producer prices coupled with expected shifts in consumer spending are expected to hinder cotton lint consumption. The International Monetary Fund currently projects global Gross Domestic Product (GDP) to grow 3.6% for calendar years 2022 and 2023 in its April 2022 outlook, down from an estimated 6.1% in 2021. Higher costs of food, transportation, and housing will limit spending on cotton products (e.g., apparel, home textiles such as bed sheets and towels, etc.). Consumers are expected to devote a greater share of disposable income to services relative to non-durable goods such as apparel this year and next year.

High prices pressure

Lastly, higher interest rates are likely to raise financing costs for consumers of cotton products and mills purchasing cotton lint. Rising global Producer Price Index levels are also expected to be indicative of slowing cotton consumption growth as mills combat rising costs, mostly notably for cotton lint. In addition, higher transportation, energy, and other input costs as well as lower cotton yarn prices relative to lint are expected to pressure profit margins. This is especially true as downstream entities such as fabric mills have difficulty operating at significantly higher prices relative to the previous year, and ultimately passing on costs to cut-and-sew/garment manufacturers.

Demand to decline

Of the top ten consuming countries, four (India, China, the United States, and Uzbekistan) are expected to decline; Turkey and Brazil are forecast unchanged from the previous year. Pakistan, Bangladesh, and Vietnam are expected to witness consumption growth. Greater spinning capacity in South and Southeast Asia is expected to drive greater cotton lint demand in these regions. However, despite greater spinning capacity relative to pre-Covid levels, India consumption is expected down and partly due to the lowest projected domestic supplies in 4 years.

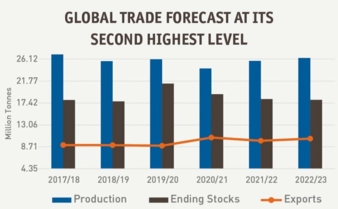

Global trade to reach second-highest level

Global trade is forecast up from the previous year to its second-highest level ever. China is projected to be the largest importer for the third consecutive year at 2.29 million tonnes due to strong demand to replenish state reserves and commercial stocks of foreign cotton in consignment. Of the top five importers, only Turkey is expected down due to higher carryin and domestic production. Exports for Brazil and Australia are forecast up with large exportable supplies. India shipments are projected lower with smaller domestic supplies.

Stocks to decline further

Global ending stocks for most major producing and consuming countries are slightly lower compared with the previous year. Despite higher global production and lower consumption, drastically lower carryin compared with the previous year is projected to cap any significant rise in stock levels. This is especially relevant to China and India, where 2022/23 carryin levels are significantly below the previous year. Lower government and/or state trading enterprise stocks in both countries show the most significant difference compared with the previous year’s beginning stocks. Since 2016/17, negative changes in cotton lint and cotton yarn prices have trended closely with downfalls in global cotton consumption.

Source: USDA, World Markets + Trade, 05/2022

Bremer Cotton Exchange – issue No. 19-20 of the Bremen Cotton Report