20/02/2019 – Discover Natural Fibres Initiative - DNFI — auf Deutsch lesen

Forecast world fibre production

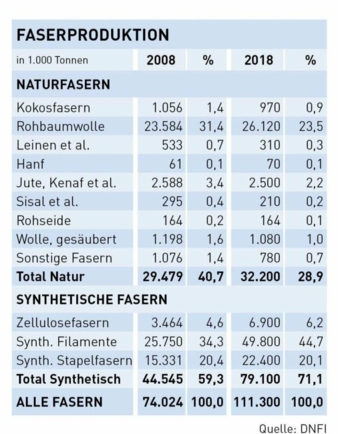

The world production of all fibres rose to approximately 111 million metric tons in 2018.

Preliminary estimates reported during the steering meeting of the Discover Natural Fibres Initiative (DNFI) indicate that world production of all fibres rose to approximately 111 million metric tons in 2018, a one-year increase of 4 million tons, and a rise over the past decade of 35 million tons.

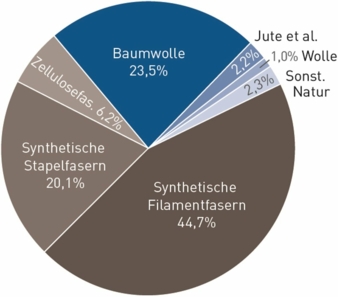

Of the world total, natural fibres accounted for 32 million tons of production during 2018, an increase of less than 2 million tons in ten years. The share of natural fibres in world fibre production fell from 41 percent in 2008 to less than 30 percent in 2018. Until today the world production of synthetic filament rose to 50 million tons; of this polyester filament alone was about 45 million tons. Synthetic staple production rose to 22 million tons, and production of cellulosic fibres rose to 7 million tons.

Cotton production in 2017/18 is etimated at 26.72 million tonnes.

Jute

According to the world market report for jute production of jute, kenaf and allied fibres fell to less than 3 million tons because of poor weather in the Ganges River Delta of India and Bangladesh. Jute markets in Bangladesh and India showed increases in value and decreases in volumes during 2018. A decreased jute production caused by poor weather means that consumption exceeds production, and stocks are being reduced. It is likely that prices could continue to increase during 2019.

Sisal

For 2018, the statistics show a Brazilian sisal export of about 26.530 tons for the period January to November. Prices for sisal have shown a downward trend since the last quarter of 2017 with lowest price level from July onwards. With the low price level Brazilian sisal has regained competition. The main outlets for the Kenyan sisal are exports to the construction industry (Saudi-Arabia, Morocco, Nigeria, Ghana) which still dominate the exports from this country. The picture in Tanzania is quite different with about 60% of the exported sisal fibre going to China. Sisal prices in East Africa (including Madagascar) have been quite stable in the past 6 month. Production and exports in 2018 have strongly been influenced by the very adverse weather conditions.

Wool

Production of wool fell in 2018 because of drought in sheep-raising areas of the Southern Hemisphere. According to the International Wool Textile Organization (IWTO) wool production figures have been in decline since 2000, with global warming and lower rainfall patterns causing the lowest wool sheep numbers since 1920. Estimated wool stock figures have dropped from 400 mkg in 2000 to less than 100 mkg in 2017. The current predictions are that global wool production will remain stable or contract slightly during 2019. The fine wool price (19-24 micron) has been on a constant upward trend during the past 5 years, from an average of around 10 USD/kg to peaking at just over 20 USD/kg in 2018. (wool.com and IWTO News) The opposite remains true of the strong wool sector, with prices still well below average and stocks remaining high. DNFI is a platform for the natural fibers stakeholder community, to facilitate the exchange of knowledge and experience among members, to advance common interests. The Bremen Cotton Exchange is an active member of DNFI.

Source: www.dnfi.org

Excerpt from Bremen Cotton Report No. 05/06 – February 7th, 2019.

For more information www.baumwollboerse.de/en