09/09/2020 – Baumwolle weltweit — auf Deutsch lesen

World stocks remain high

Covid-19’s negative impact on cotton demand was too late in the season to shift planting decisions away from cotton for most major producing countries.

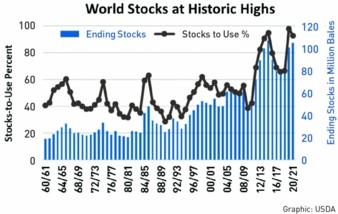

At the beginning of the season the world stocks-to-use ratio was in the mid-sixties, the upper bound of the long-term range, and little change was expected in 2019/20.

However, 2019/20 production remained relatively high as the Minimum Support Price (MSP) in India helped push its production to near-record levels and has resulted in the government acquiring significant levels of stocks. Moreover, Brazil registered its third consecutive record crop, as most production has shifted to second-crop cotton, which has a lower cost of production.

Covid-19 slows down world cotton demand

The USDA Outlook in February of 2020 projected that 2020/21 would be similar to 19/20, with modest consumption growth and a modest decline in world stocks. Then Covid-19 spurred record downward adjustments to global cotton demand. Current USDA estimates show global consumption in 2019/20 and 2020/21 together down just under 5.4 million tonnes (with 2020/21 down 15 percent) from the February Outlook projections. The 2020/21 world production forecast is virtually unchanged, and Covid-19’s negative impact on cotton demand was too late in the season to shift planting decisions away from cotton for most major producing countries. This has pushed the stocks-to-use ratio back up into the 90 percent range.

Additional end-use demand crucial

Looking ahead, with government support programs in in the two largest producing countries, China and India, shielding producers somewhat from price volatility, lower prices will have limited impact on global production. Given that the massive drop in demand in recent months was not price based but due to the impacts of Covid-19, lower cotton prices alone will have little impact on demand. Before global stocks can be drawn down to more traditional levels, endues demand will have to recover from the current Covid-19-reduced levels.

Source: USDA/FAS, Cotton: World Markets and Trade, August 2020

Bremen Cotton Report No. 33/34 – August 27, 2020