28/01/2022 – Roadmap overview

The Smart Textile Value Chain Map

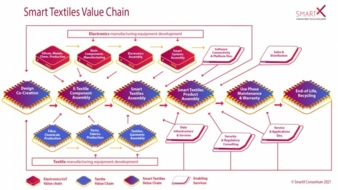

One of the major issues facing European smart textile innovators is the key manufacturing gaps that currently exist in the smart textile value chain. The new Smart Textiles Value Chain Map of SmartX provides an overview of the complex value chain, lists specific challenges facing the industry, and points out which issues need to be addressed.

The smart textiles value chain comprises multiple actors from three distinctive industries, namely electronics, textile, and ICT (Information and Communications Technology). This underlines both the need for cross-sectoral partnerships and how challenging it is to bring together competencies, energies and strategies based on three very different industries, viewpoints, and mindsets.

Currently, product development is predominantly driven by a technology push. Many products only reach the prototype stage because of the absence of (large-scale) manufacturing capabilities and the challenges related to the difficulty of finding the right long-lasting partnerships.

The graphic shows the full value chain map of smart textiles. The cross-sectoral value chain covers the hardware part, the software part, the textile part, and the end-product.

This analytical map has been designed by SmartX Europe partners, putting together their knowledge of the different stages, nodes, and components of this smart textiles value chain. It aims to give a clear vision of the whole interactive pattern, but more specifically to identify the current gaps that slow down or jeopardise the successful development of the European industry of smart textiles.

Current challenges facing European smart textiles

Starting with textile equipment manufacturers, one can observe that the possibilities for simply adapting the equipment to smart textile production are clearly running out. It is up to traditional textile businesses to sensitise their suppliers on the need for fully novel machinery. A closer collaboration with EU research centres could greatly foster the industrialisation of lab innovations to develop such necessary new machinery.

Another gap can be observed in terms of chemical supplies, which are key to the functionalisation of smart textiles. Of course, such inputs are mostly outside of the scope of the smart textile value chain (e.g. metals, pigments etc.). They are produced by large players who are used to – and keen on – producing and supplying very large quantities for traditional textiles, whereas smart textile businesses usually need very specific materials in limited quantities, necessitating the involvement of dedicated formulating intermediaries.

On the skills front, one can observe that in order to develop innovative yarns, fabrics, coatings or embroideries, most traditional textile manufacturers are lacking in some key competencies to use new processes and new materials, or design new commercial strategies to develop, manufacture, and bring products to the market. In particular, textile companies usually lack specific knowledge of electronics, which prevents them from being actively involved in scaling up smart textile manufacturing.

Another crucial challenge for the industry lies at the assembly stage of functionalised items or garments. The latest design and CAD software, enabling the creation and alignment of cutting patterns for the textile articles assembly can be used, but very few examples of an automated, larger-scale production can yet be seen in the industry.

Read the entire article in our current issue. Click here to subscribe.