04/06/2020 – A survey among the members — auf Deutsch lesen

Corona: IVGT asks members about the current situation

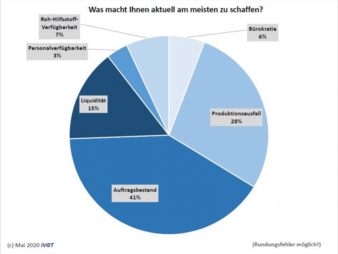

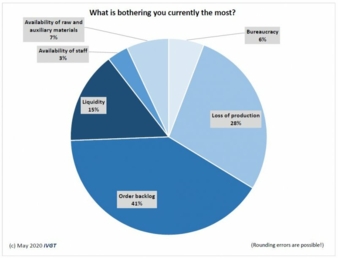

In May approx. 76 percent of the companies reported massive declines in incoming orders.

In a comparison of April 2020 with April 2019, the figure showed a decline by 63 percent. In May nearly 35 percent more companies than in April have announced short-time work. This reflects the current development according to the German Federal Employment Agency, that around one third of all industrial companies entitled for it had already applied for short-time work for their employees by mid-April.

While 29 percent of the companies had dismissed employees in April, by May 36 percent of the companies are already planning to take this step. This represents an increase of 24 percent.

At present, 22 percent of the companies surveyed by IVGT have an interruption of operations or considering it. This situation is nearly unchanged - as it was in April with 23 percent. Delivery dates are endangered by plant closures and short-time working - especially at contract finishers and suppliers.

Slight relief in the supply chains

There has been a slight easing of tensions regarding supply chain disruptions and problems with the availability of raw materials and supplies. The number of interruptions in the supply chain decreased by a good 31 percent compared to the previous month. The availability of raw and auxiliary materials is now causing problems only for 27 percent of companies. In April almost twice as many companies reported difficulties on this point.

Continued shortages of dyes, chemicals, yarns and fabrics

Bottlenecks exist mainly for dyes and chemicals and for some yarns and fabrics from the EU (e.g. Italy and Spain), but also from Asia. In border areas with Poland or the Czech Republic, the daily border crossing of employees is still difficult and freight times have increased.

Bank loans?

In the current survey, the companies were asked about their experiences in applying for KfW (development bank) loans and the national protective umbrella for trade credit insurance, which the German government has put in place together with credit insurers to maintain functioning supply chains during the crisis.

The majority of textile companies neither take out KfW loans nor do they have any experience with the national protective umbrella method. The companies that have applied for a loan criticise an excessively long lead-time by their house banks, which have to approve it.

Despite this, KfW loans were granted in individual cases, even though loans are not considered a solution in principle because they have to be repaid or they cannot replace missing orders. Access conditions and requirements for promotional loans should be simpler and aid funds disbursed more quickly.

There is a general demand from the industry that consumer consumption must be stimulated. Unfortunately current lack of coordinated action across all national borders, lead to further unsettle consumers.

Above all it is demanded that there must be a reduction in energy costs, since affordable electricity and natural gas prices are of utmost importance for the German textile industry. Regarding trade credit insurance, the companies note a generally bad rating for the textile industry, which is often equated with the textile retail trade and clothing.

Michael Pöhlig - Managing Director IVGT