22/07/2019 – Uncertainty is the new normal — auf Deutsch lesen

Cotton prices remain under pressure

The consequences of the trade dispute between the US and China are clearly noticeable, even though the expectations have moved away from escalation and towards reconciliation.

The USA and China are among the big players in the international cotton industry. The USA is the largest cotton exporter and the fourth largest cotton producer, with currently growing stocks. Alongside India, China is the world's largest producer, the largest consumer and at the same time, the largest importer of cotton. This is also the reason for the widespread insecurity in completing contracts in the international cotton trade. As a result, the volatility of cotton prices has continued to increase.

Declining values – falling prices

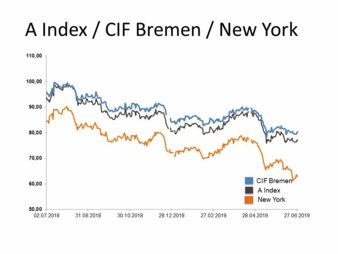

At the beginning of June 2018, the time of the first increase in import duties by the USA and the increase in tariffs on agricultural products in China, cotton was trading at 100 cents/lb, based on the A Index. The price fell to 94 cents/lb in August/September, as trading tensions increased due to higher import duties and counter duties. A further decline followed in the period between October 2018 and April 2019, with fluctuation ranging from 80 cents/lb in February to 88 cents/lb in April. As negotiations to settle the dispute suffered a setback at the beginning of May, prices reached only 76 cents/lb. On July 15, quotations reached 73.65 cents/lb.

Despite the trade dispute, which appears to be the ‘new normal’, global cotton consumption in the 2019/20 season is expected to increase by 1% to 26.9 million tonnes, according to calculations by the International Cotton Advisory Committee (ICAC). China is expected to fall by 200,000 tonnes to 8.25 million tonnes. However, with this result, the country remains by far the largest consumer of cotton, with cotton imports likely to increase to 2.1 million tonnes due to the normalisation of cotton reserves in the country.

Constant pressure on cotton prices

Cotton production is expected to reach 27.6 million tonnes in the 2019/20 season, an increase of 7 percent. At this level of supply and demand, global stocks are expected to rise to 18.6 million tonnes. In the previous season 2018/19 they reached 17.9 million tonnes, the lowest level since 2012/13.

This alone should keep pressure on cotton prices in the medium term. Added to this are the uncertainties caused by trade disputes, as well as a slowdown in economic growth in Europe and possibly also in the USA, where there is big for cotton textiles and clothing.