28/03/2019 – Vietnam — auf Deutsch lesen

Chinese demand drives cotton consumption and yarn exports

Vietnam’s textile and garment sector is growing steadily and remains one of the county’s top export industries, significantly contributing to the country’s Gross Domestic Product (GDP) growth.

Vietnam Textile and Garment Association estimates that export revenue in calendar year (CY) 2018 will reach $36 billion, up about 14 percent over the previous year.

The escalating trade tensions between the United States and China have given Vietnam an opportunity to increase apparel exports to the United States. Garment exports from Vietnam to the United States reached $12.4 billion in the first 11 months of CY18, up 9 percent over the same period last year.

Yarn exports

The trade tensions have not yet adversely affected Vietnam’s cotton yarn exports to China. In fact, Vietnam Customs data shows that cotton yarn exports to China will reach about 780 thousand metric tons (TMT) in CY18, up 9 percent over CY17. In CY18, Post estimates Vietnam’s total yarn exports at 1.45 MMT, up about 7 percent over the previous year, of which approximately 1.05 MMT were cotton yarns (HS 5205 and 5206). China, South Korea, and Turkey remain the largest importers, comprising over 80 percent of Vietnam’s total cotton yarn exports. The decline in exports to Turkey was more than offset by higher exports to China and South Korea.

Trade

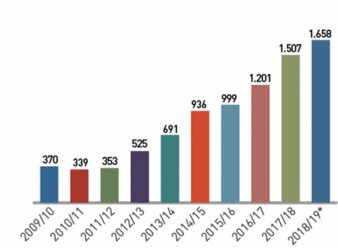

Post revises Vietnam’s cotton imports in MY17/18 to 1.50 MMT, or just over 6.9 million bales, up 26 percent over MY16/17, due to higher exports of cotton yarns to China and South Korea. For MY18/19, based on the recent developments in the textile and apparel sector noted above, Post forecasts imports at 7.6 million bales or 1.66 MMT, a 10 percent increase over MY17/18. The country’s top five cotton suppliers are the United States, India, Brazil, Australia, and Cote d‘Ivoire. These countries make up 70 to 80 percent of the total cotton supply to Vietnam.

Consumption

Vietnam’s cotton consumption continues to increase to meet the growing demand for cotton yarn from export markets, most significantly China, South Korea, and Turkey. FAS/Vietnam estimates that 80 percent of imported cotton was spun into cotton yarn (HS 5205, 5206) for export, while the rest was made into yarns of various types for domestic consumption. Vietnam’s cotton consumption heavily depends on China’s demand for cotton yarn, while domestic consumption of cotton yarn is less robust. Overall, China’s policy of favoring imports of cotton yarn from Vietnam while reducing imports from India and Pakistan increased Vietnam’s cotton consumption in MY17/18. In MY18/19, FAS/Vietnam forecasts Vietnam’s cotton consumption at 7.5 million bales or approximately 1.64 MMT, up about 10 percent over MY 2017/18, due to recent developments in the textile and spinning sector.

Vietnam’s cotton planted area continues to shrink to an insignificant amount. FAS/Vietnam estimates domestic cotton supply at less than 1 percent of total market demand.

Source: USDA/FAS Gain Report, February 2019

Excerpt from the Bremen Cotton Report No. 09/10 – March 7th, 2019.

For more information www.baumwollboerse.de/en