16/09/2022 – Cotton — auf Deutsch lesen

2021/22 U.S. exports fall on lower supplies

2021/22 U.S. exports are estimated to have fallen more than 370,000 tonnes from the previous year to 3.2 million tonnes owing to less exportable supplies.

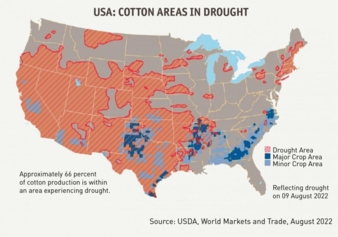

Despite higher production, beginning stocks in August 2021 were more than 870,000 tonnes lower than a year earlier, and depressing export volumes in the first half of the marketing year. Higher domestic consumption and logistical constraints also constrained shipments. According to USDA Export Sales Reporting (ESR), total 2021/22 shipments were 3.05 million tonnes, 152,000 tonnes lower compared with the USDA forecast. Since the 2017/18 marketing year, USDA computes official exports as the mid-point between ESR and U.S. Census Bureau shipments. From August through June, Census exports exceeded ESR by more than 218,000 tonnes. For the second consecutive year, China was the largest export market and accounted for roughly onethird of U.S. shipments according to ESR data. Most exports to China were intended for state reserves. Of the top ten export markets in 2021/22, Türkiye, India, and Peru witnessed higher exports relative to the previous year. 2022/23 U.S. exports are forecast to fall more than 544,000 tonnes because of significantly less exportable supplies compared with the previous year. Production in 2022/23 is forecast to fall roughly 1,09 million tonnes to 2,74 million tonnes because of drought, particularly in Texas which normally accounts for more than one-half of U.S. plantings.

2022/23 Outlook

Global production is lowered 675,000 tonnes with the decline attributed to the United States. Global use and ending stocks are down 174,000 and 327,000 tonnes, respectively. Global trade is down 392,000 tonnes led by a reduction of 435,000 tonnes in U.S. exports to 2.61 million tonnes, and China imports lowered 218,000 tonnes to 1.96 million tonnes. Imports were also lowered for Bangladesh, India, Pakistan, Türkiye, and Vietnam. The U.S. balance sheet shows significantly lower production, exports, and ending stocks. Production is lowered nearly 653,000 tonnes and due to historically high abandonment in the U.S. Southwest; ending stocks are forecast at their lowest level in nearly 100 years to 392,000 tonnes. The projected U.S. season-average farm price is forecast up 2 cents at 97 cents per pound.

Source: USDA, World Markets and Trade, August 2022

Bremen Cotton Exchange – Issue 33/34 2022, Bremen Cotton Report