04/09/2020 – Deceleration along the textile chain — auf Deutsch lesen

The Fiber Year 2020 – characterized by the coronavirus

Andreas Engelhardt: The entire textile value chain suffered from significant deceleration last year before a dramatic contraction began.

Economic outlook projections from IMF for 2019 were repeatedly revised downwards from 3.9 percent global growth published in July 2018 to just 2.9 percent released at the World Economic Forum in Davos in January 2020. Hence, world economic growth recorded its slowest pace since the financial crisis a decade ago.

Intensifying trade uncertainties and barriers, slowdown in advanced economies, weakness in some large emerging markets and geopolitical tensions weighed on business sentiment and resulted in machinery investments and household consumption to decelerate.

Adverse business conditions affected the global textile industry, and the entire textile value chain suffered from significant deceleration last year before a dramatic contraction began after the coronavirus outbreak.

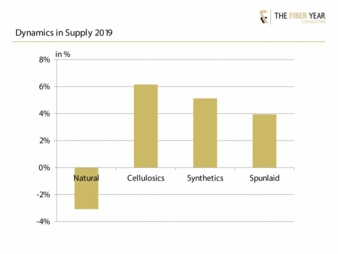

Supply from natural fibers growing, manmade fiber and spunlaid production slowed to less than 3 percent growth from almost 7 percent expansion in the year before.

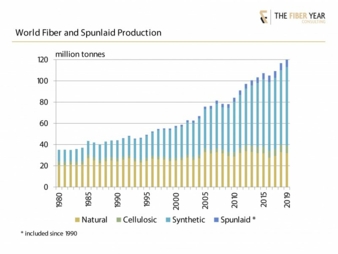

Global supply was expanded by spunlaid nonwovens that meet almost one kg per capita textile demand by now. This web-forming process skips a production stage as the polymer-based technology directly delivers a finished fabric. The total market size at supply side accounted for 120 million tonnes, which translates into an average consumption of almost 16 kg per capita. Cultivation of natural fibers decreased 3 percent to 32 million tonnes with cotton output after two-year growth falling faster to 26 million tonnes, wool softening nearly 1 percent, bast fibers projected to have grown by 1 percent, while other natural fibers were relatively stable.

Manmade cellulosic fibers continued their dynamic growth, expanding more than 6 percent to 7 million tonnes.

Viscose staple fibers including modal and lyocell accelerated 8 percent, while filaments witnessed a modest decline and acetate tow experienced modest growth. Synthetics achieved 5 percent growth thanks to robust expansion of polyester filaments and staple fibers, whereas nylon slightly rose and both acrylic and polypropylene fibers weakened.

Small-scale fiber segments like aramid, carbon and spandex fibers all experienced growth at decelerated pace.

Last year’s dynamics in the four market segments revealed quite different results.

The performance in 2019 was characterized by output of natural fibers falling 3 percent, which was the tenth yearly decline in the century. It was predominantly caused by reduced cotton production in the 2018/19 season after double-digit gain in the season before. The entire manmade cellulosic fibers business continued to outperform the market after growing more than 6 percent and synthetics, predominantly polyester, advanced 5 percent.

The slump in cotton demand as direct response to coronavirus

Global supply decelerated from almost 7 percent growth in 2018 with manmade fibers further enlarging their share to 68 percent.

Textile and clothing trade for 60 countries compiled in the report including extra-EU shipments witnessed a reduction compared with 2018, exports down 1.3 percent and imports declining 1.7 percent.

Most of the leading exporting nations suffered from decreases. Chinese exports softened 1.9 percent to USD272 billion after two-year recovery as essentially apparel shipments dropped 4.0 percent to USD151 billion, down USD35 billion from peak in 2014.

The U.S.-China trade war has left its mark on bilateral trade.

U.S. imports fell 10.1 percent, equal to a shortfall of USD4.1 billion. Chinese global exports in the first half 2020 delivered a mixed picture with textile exports surging more than a quarter but apparel shipments contracting 22 percent. Bangladesh managed to marginally lift exports to USD36 billion in 2019 but suffered from a hefty plunge of apparel shipments in April at -85 percent and May -62 percent. Strong increases in last year’s exports have further been observed in Vietnam (+6 percent), Myanmar (+23 percent), Cambodia (+10 percent) and Brazil (+38 percent). Brazilian exports marked an all-time high following record high cotton shipments. Bumper cotton crop confirmed the country world’s second-largest export position behind U.S., marking a new all-time high and further expansion in 2019/20 season is projected in ICAC’s July release for production (+4 percent), exports (+45 percent) and ending stocks (+15 percent) although export growth will be increasingly challenged by the U.S.-China Phase One trade deal signed in January 2020 and slowing cotton demand across all markets in Asia that scaled back purchases.

By Andreas Engelhardt, President, The Fiber Year GmbH