16/11/2020 – Andreas Engelhardt, The Fiber Year and Groz-Beckert — auf Deutsch lesen

The Fabric Year 2020

Following events in 2016 and 2018 at Groz-Beckert headquarters, the 2020 edition of the presentation series “The Fabric Year” was held as digital event.

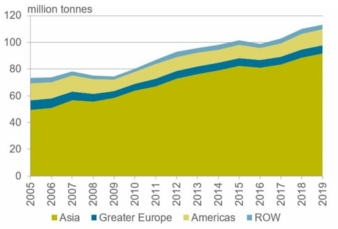

The development of fiber and yarn production by region over the quota-free period shows:

that annual average growth momentum since 2005 amounted to a little over 3 percent

while corresponding population growth amounted to just 1.2 percent.

This quantity is basically precursor for knitting and weaving operations, used for fiber-based nonwovens and part of the unspun segment.

Unspun applications are for example filling and insulating materials as well as fibers for cigarette filters.

Some major industries like Bangladesh and Vietnam are heavily reliant on foreign sourcing of fiber and yarn in order achieve a national availability of fiber material that allows processing capacities running.

The long-term knit fabric production continues to consolidate within Asia, which currently counts for 86 percent of global knit fabric production.

This is a significant increase from 2005 when Asia counted for 65 percent of knit fabric production. The output of woven fabrics also succeeded to mark a new all-time high with the Asian share amounting to 91 percent of woven fabric compared with 80 percent in 2005. Steady growth of nonwovens went on with volumes more than doubling in the quota-free period.

In 2019 we saw only a minor increase in output across all technologies, representing a 2.8 percent growth year-on-year in volume terms to about 116 million tonnes.

However, at the same time WTO reported a decrease in value terms for textile trade of 2.4 percent compared to last year.

Evidently, 2019 was a year of tremendous price pressure for manufacturers in the textile sector. Firstly, tariffs imposed by the United States on Chinese textiles have had a heavy impact on Chinese apparel exports and export revenues, and have sped up the trend of diversified sourcing, reducing overall sourcing volumes of finished goods from China. Secondly, as apparel sourcing increased in, primarily, Bangladesh, Vietnam, Cambodia and Pakistan, these countries which gained from China’s loss do not yet have sufficient local capacity to produce enough fabric to meet demand at a competitive price. These growing garment hubs mostly remain net importers of fabric.

Last year we saw significant increases in imported fabric, primarily knitted polyester fabric, mainly from China to all major garment making countries at lower prices than in previous year.

Asides from China increasing its fabric exports to the world, broadly we did not see any major shifts in critical production and sourcing destinations.

Asia retained the majority market share in both apparel and fabric making.

Vietnam stood out once more a crucial market which continues to gain importance on the global stage. Trade data deliver quite an objective view on current market conditions. The export performance between January and August reveals almost without exception heavy double-digit losses but the worst seems to be over with plummeting contractions between mainly March and May, falling about 85 percent in Bangladesh in a single month at its peak.

Gradual recovery is noticeable – although not for all countries listed, and at rather different speeds

Growth rates in positive territory are quickly identified: Textile exports from China soared by a third due to sharp increases in personal protective equipment, predominantly face masks, that conveniently put the textile category into positive growth despite heavy losses in exports of textile raw materials, yarns and fabrics.

In addition, the export value from Brazil was another exception following bumper cotton crop last season.

Cotton exports play the decisive role in export growth.

Cotton stocks at 3 million tonnes in the actual season exceed production, which has been a rare event in recent decades and, at the same time.

Global stock levels coming close to annual demand, may put pressure on cotton prices in future.

Negative 8-month trends

Further comments, unfortunately, rather describe negative 8-month trends. The Chinese garment export growth rate with double-digit negative growth between March and June turned positive in August after 5 monthly decreases but still is 16 percent below last year’s period.

The slump poses a severe challenge to the economy in Bangladesh as the textile chain is of paramount importance to generate foreign exchange, with its share in national exports being one of the highest in the world at nearly 90 percent.

Bangladesh shipments succeeded to grow in August in local currency for the first time this year, surging by 52 percent in knitwear year-on-year and by 39 percent for woven garment.

A roller coaster ride in Turkey

Turkey’s export performance looks like a roller coaster ride, benefiting from strong gains in the first two months after coronavirus outbreak in Asia as European apparel orders moved to Turkey with essentially woven garment exports soaring 9 percent. Total shipments fell between 23 percent and 61 percent each on monthly basis from March to May after Europe became the new epicenter of coronavirus infections.

Turkish exports in June surged nearly 20 percent year-on-year but dynamics significantly lost momentum in July and August with around 6 percent growth each.

The U.S. performance in particular suffered from extended lockdowns in the region where most of its fiber and fabric materials are being shipped to for further processing before re-entering U.S. as final piece of garment. Pakistan’s Q1 exports managed to slightly grow before falling 23 percent in Q2 and double-digit losses remained for July and August each. No significant improvement was observable for Indonesia, Korea, Taiwan, Thailand, Mexico and Sri Lanka as their export performances from March continuously remained in negative territory with predominantly double-digit rate of contraction, also in August.

In 2020 there has been an overall dip in consumer spending in almost all markets around the world

Non-essential spending, including many textile products has been hit heavily, and early on in the coronavirus crisis, lockdowns around the world forced retailers to close their doors, reduce operating hours and emptied high streets. Despite that, many retailers and brands have seen a significant positive uptick in online sales, but even this has not been enough to keep total demand buoyant.

In China, first half 2020 retail sales of apparel and footwear dipped by almost 20 percent but online sales remained stable. In the United States of America, apparel imports are down by almost 30 percent in value terms from January to August, and down 25 percent in volume terms. China’s total market share of US apparel imports dipped significantly, mainly due to China effectively being shut at the start of the year as strict lockdowns kept much of the workforce at home. While other countries have gained more share in the total pie of US imports, in reality, total volumes sourced from all destinations have decreased quite significantly. Slightly more positive though, Japanese apparel imports have dipped only 3.5 percent in value and 6.8 percent in volume terms up until August 2020.

Apparel consumption in Europe dipped by 24 percent in volume in the first half of 2020, despite high hopes for a sooner rather than later recovery.

New lockdown measures and persistent economic headwinds in the second half of the year suggest that demand might still continue to depressed for a longer time than expected.

The crucial question is what is coming next?

We have seen so far that the simultaneous crisis of supply and demand poses a life-threatening burden for the entire world and economic activity is not expected to normalize on short notice despite policy support. However, some key parameters became apparent by now. No matter whether it will be late next year or in 2022, the world will not return to what life was like before January but rather adjust to a “new normal”, which will be on a lower level we all got used to before.

Changes in future sourcing may occur for essentials of life like, for example, pharmaceuticals but apparel is neither strategic nor essential but just a fashionable item with ongoing pressure on prices, hence, a revival of local manufacturing appears unlikely.

Relocation of processing chains from low-cost countries seems implausible and to safeguard against future supply-chain shocks is not a strong argument to re-shore garment capacity to higher-cost domestic markets in the age of shareholder value and quarterly earnings reporting.

Demand will remain depressed, in particular, in the apparel business that consumes more than 55 percent of world fibers.

Remote work tools – why should people buy new outfits?

Companies have invested in remote work tools, identifying all of a sudden a new potential for cost savings, and without having workplaces or recreational spots to go why should people buy new outfits? Wearing a white shirt during a Zoom conference and afterwards going back into the closet until the next virtual meeting will not prompt consumers to refresh their wardrobe from season to season. The segment of carpets and home textiles has experienced positive signs as mass work-from-home policies have inspired people to refurbish their home.

Growing private residential expenditures for a certain period of time cannot compensate for missing nonresidential investments.

Ongoing store closures in favor of online sales and continuous working from home with more office space remaining vacant will not only significantly change townscape but also result in a possible housing crisis.

Less business traveling and ongoing travel restrictions will also contribute to reduced demand from hotels and restaurants.

Technical textiles have been struggling already before Covid-19 outbreak as global vehicle production began to decline in 2018 and, for instance, European new passenger car sales in January to August contracted by a third, down 3.6 million vehicles over last year. The car industry firstly needs to overcome a structural crisis that got worse this year with Covid-related falling disposable incomes, millions of job losses and consumers’ increasing wait-and-see attitude on emissions-free mobility.

The Fabric Year

Following events in 2016 and 2018 at Groz-Beckert Headquarters, the 2020 edition of the presentation series “The Fabric Year” was held as digital event with a high number of attendees. This article concentrates on world summary.

Andreas Engelhardt, The Fiber Year and Groz-Beckert